seattle payroll tax calculator

How to File a Tax Return. You are able to use our Washington State Tax Calculator to calculate your total tax costs in the tax year 202223.

The Complete Guide To Washington Payroll Taxes For Businesses 2022

Calculate your Washington net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Washington.

. Your household income location filing status and number of personal exemptions. Or to make things even easier input. Seattles new JumpStart Tax is a payroll tax applied to businesses operating in Seattle with at least 7 million in annual payroll on employee compensation greater than 150000 pa.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. As detailed in the original article published by Clark Nuber in July 2020 the Seattle City Council passed City Ordinance 126108 establishing a new Seattle payroll expense tax that takes effect. Seattles Finance and Administrative Services Department FAS has released an updated payroll tax ruleThe administrative rule was updated because in April Seattle City Council passed.

Employers can file a tax return online here or manually by. Just enter the wages tax withholdings and other information required. The table below shows.

Sales tax total amount of sale x sales tax rate in this case 101. Plug in the amount of money youd like to take home. The City of Seattle Washington will impose a new employer-only Payroll Expense Tax effective 1 January 2021The filing of this tax was optional until Q4 2021and Zenefits is supporting this.

To calculate the amount of sales tax to charge in Seattle use this simple formula. Learn how Fingercheck helps you do business better. While local sales taxes in Seattle Tacoma and some other metro areas are significantly higher than the national average.

Rates also change on a yearly basis ranging from 03 to 60 in 2022. Washington Hourly Paycheck Calculator. Our calculator has recently been updated to include both the latest Federal.

2022 Minimum Wage Calculator Calculate the 2022 minimum wage for employees working in Seattle. 7386494 or more of payroll expense in Seattle for the past calendar year 2021 and. Payroll Tax Calculator helps employers and employees figure out payroll tax rates.

Use ADPs Washington Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. The tax rate ranges between 7 and 24 and is based on both the annual compensation paid to each employee and the total Seattle payroll expense of the business. These changing rates do not include the social cost tax of 122.

2021 Social Security Payroll Tax Employee Portion Medicare Withholding 2021 Employee Portion To contact the Seattle Department of Revenue please call 360-902-9620. For 2022 the wage base is 62500. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

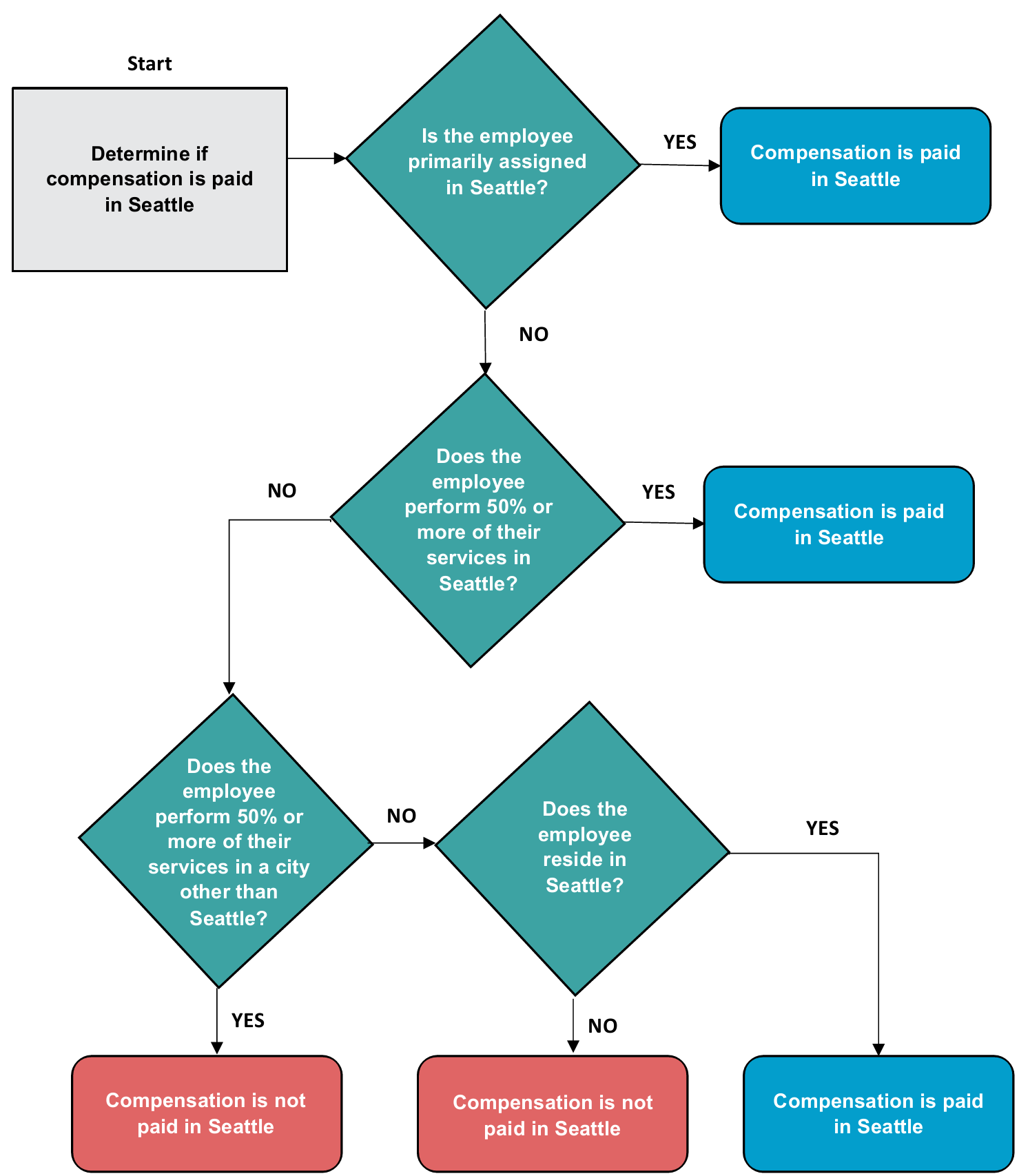

Use the paycheck calculator to figure out how much to put. The payroll expense tax in 2022 is required of businesses with. Employers must calculate the Seattle payroll for all employees including those earning less than 150000.

Compensation in Seattle for the. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

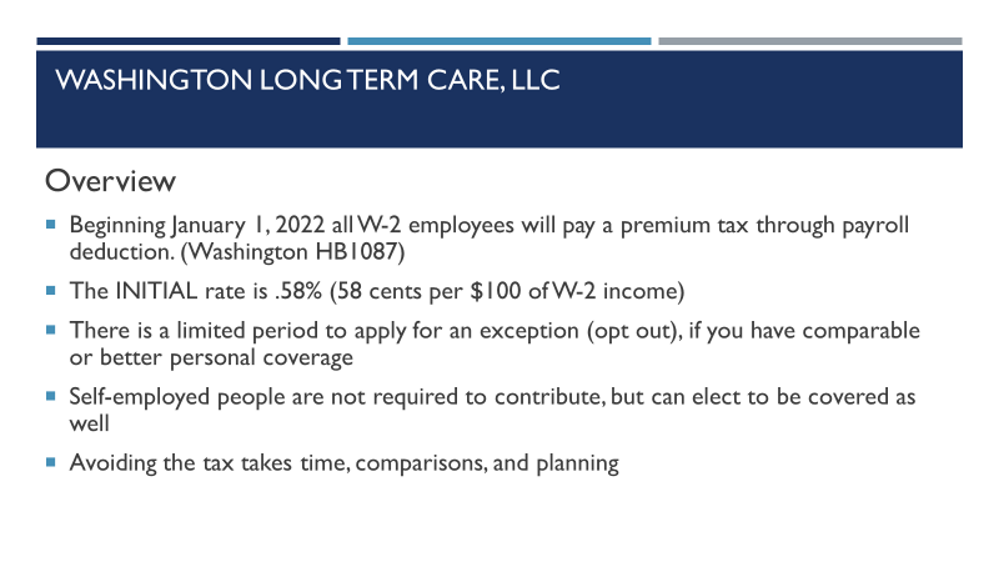

Answers To Your Questions On The New Washington Cares Fund And The Long Term Care Payroll Tax The Seattle Times

Payroll Tax Calculator For Employers Gusto

What Is The Irs Form 941 Payroll Tax For Employers

Should My W2 Include Income From An 83 B Election

The Complete Guide To Washington Payroll Taxes For Businesses 2022

Washington Paycheck Calculator Adp

Trump S Proposed Payroll Tax Elimination Itep

The Complete Guide To Washington Payroll Taxes For Businesses 2022

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps

Blog Diwan Accounting Cpa Bookkeeping Payroll Tax East Side Seattle Wa

Seattle S Payroll Expense Tax Upheld By Trial Court Time For Employers To Gear Up For Reporting Insights Davis Wright Tremaine

Jo Ann Kelly Cpa 3400 Harbor Ave Sw Seattle Wa Yelp

Colin Efelle Creative Seattle Wa

Indeed Salary Calculator Indeed Com

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

Payroll Washington Long Term Care Llc

Here S How Much Money You Take Home From A 75 000 Salary

Tax Extension Deadline What Are Common Mistakes Taxpayers Make Marca